Learn What Is ARV and How to Calculate ARV

Real estate is one of the most profitable and popular investment channels in 2020, as its potential for success is greater than ever. Businesses and professionals have started investing in real estate as it allows them to build equity for the future, generate passive income, provide cash flow for retirement, enjoy tax benefits through depreciation, provide leverage, mitigate the risk, and offer flexibility.

There are many things to learn in real estate investment. In flipping houses, for instance, the After Repair Value (ARV) is one of the essential terms to understand and study.

But what is it exactly?

How to calculate ARV?

Why is it important?

How does it affect the return on investment?

Worry no more! We’ll explain everything you need to know about ARV. Are you ready? Let’s get started!

What is ARV In Real Estate?

Have you ever encountered ARV but don’t know what it is? Well, it stands for After Repair Value. How does it work? It is the total estimate of a distressed property’s value after an intensive refurbishment.

Renovations for residential property usually include cosmetic work, remodeling projects, rehabilitation, and rehab.

Utilized by fix-and-flip real estate investors, ARV allows them to predict the worth of a fixer-upper property after reconstruction. That’s not all! ARV helps aspiring and prospective investors to measure and assess whether or not there’s sufficient margin for the flip to increase profits and ROI.

Determining the ARV is a critical step in house flipping projects of any size and type. It tells investors how much they can sell a real estate property after a repair. It also gives them an idea of how much they need to spend on renovations.

So, without calculating ARV, you waste both of your time and money on a fix-and-flip project.

How To Calculate ARV?

Calculating After Repair Value can be done using a calculator, there are several tools out there, like this ARV calculator for example:

ARV CALCULATOR

How much is my property worth?

Here are 3 things to help you better calculate the ARV

Estimate the Current Value of your Property

While there are many overwhelming factors to bear in mind, estimate a specific real estate property’s current value or the As-Is Value.

It is advisable to take advantage of a professional and reliable appraiser to get the job done for you.

Real estate appraisers have prior experience and wide expertise in valuing real estate properties of any size. They know what to look at in a particular real estate and identify costly defects. They will also provide a highly accurate and precise estimate of your asset’s current value.

But if you have prior experience, you can calculate the As-Is value on your own to cut unnecessary costs and enjoy a new learning experience as an investor.

Estimate the Value of Renovations

After estimating the current value of your property, your job does not stop there. How much money does your renovation require? Read on for further details.

Before estimating the value of renovations, it is important to identify the costs of repair to ascertain the profitability of your project. Remember that the costs must be less than the value of renovations to make and enjoy a good profit.

Simple Tips to Achieve an Accurate and Precise Estimate

Get Estimates From at least 3 Trusted Contractors

Make sure to ask them to prepare a list of all required repairs. As you receive the information, try to compare different costs. But be wary when hiring a contractor. The trick here is to choose an experienced and qualified professional for your safety and convenience.

Estimate the Necessary Materials

To calculate how much materials you need to complete a home repair project, a feature-packed and quality calculator is worth the effort and cost. Then, check available local stores.

Also, don’t feel ashamed of materials that can be purchased at an affordable price range. Buying at discounts is a brighter idea. Take your time. Don’t take any shortcuts.

Consider Possible Buyers to Set the Right Budget

To understand what kind of home quality potential buyers expect from a property, analyze and study your target market.

Yes, it can be confusing at first. But this can help you avoid wasting money and over-repairing a specific real estate. Seek assistance if the need arises.

Apart from renovations and repairs, there are other expenses related to flipping a property. It is crucial to consider closing, holding, financing, and marketing costs.

If you’re planning to hire a handyman to get the renovation done, include labor expenses. Then, factor the costs into an hourly rate.

What else? Estimate how many long it will take to finish the project.

Perform a CMA

Since you’ve got the components of ARV formula, it’s time to calculate the property’s After Repair Value. Find the real estate comparable to check the number. These properties are either sold or up-for-sale.

In Comparative Market Analysis (CMA), it’s necessary to look for house comps that you expect a property to look like after a renovation.

Investors want comps that are within a mile of a real estate, located in the same neighborhood, sold within the last 4 months, or similar in square footage.

Be sure the ARV is equal to the real estate comps. If it doesn’t match, you’ve possibly made an error. But it depends. Sometimes, it indicates that a fix-and-flip project won’t result in a profitable real estate investment.

How to find real estate comps? Good question? The Multiple Listing Service is a reliable source you should try. Also, partner with a certified and licensed real estate agent.

As an excellent alternative, utilize responsive and relevant applications online.

ARV Calculator

If you don’t have enough time, take advantage of the ARV calculator. In fact, there are many options online. Just be careful when selecting the right solution. You can ask a friend for some referrals to save your time and reduce unnecessary efforts.

Why Should You Invest in a Quality ARV Calculator?

The manual calculation of AVR leads to mistakes. Although you’re good at Math, errors do happen. So, it is ideal to use a calculator for accuracy and precision. Error-free After Resale Value can help prevent unnecessary problems from happening.

Additionally, it is easy to forget or leave out something when computing ARV. A relevant and responsive calculator can get the process done without missing out on any important details.

ARV calculator is available in a variety of options. There is a browser-based, excel-based, and JavaScript-free software to pick. Before making a decision, identify your needs to achieve and enjoy a risk-free, quick, and reliable selection.

Why Is ARV So Important?

Why do investors calculate ARV real estate? Well, there are various reasons. Some of them are highlighted below. Take a look.

Have Confidence When Making Decisions

It’s a good idea to rely on a wholesaler, real estate agent, and other professionals in determining the value of a property.

But don’t ignore the importance of verifying any data on your own. This will give you confidence when making decisions in the future. You won’t feel skeptical. You will also be firmer and more positive whenever you make any investing action.

Measure and Ascertain Real Estate Profit

The ARV will be the target sales price once a fix-and-flip project is finished. It’s intended to identify the potential profit of a specific deal. Are you going to let go of the buyer? Or will you be looking for a new client? The ARV real estate will help you know and understand.

Set Maximum Remodeling Budgets and Bid Amounts

Setting bid amounts or remodeling budgets is not a guessing game. The ARV comes in handy. If you experience some trouble setting a maximum budget for renovation/repair, the ARV has got you covered.

Figure Out the Selling Price of a Fix-and-Flip Project

Setting the right price is key for a fix-and-flip project. However, new investors may sell a property with a high and unrealistic price. Remember that overpriced homes don’t sell. You can set a low rate. Don’t be afraid as this will just generate multiple offers. You may request an online offer from online buyer, it only takes minutes and you can get the offer in your inbox in 24h or less.

To avoid any confusion, calculating the ARV is a better idea. Yes, it can be hard to compute. But figuring out the selling price of a fix-and-flip house will be stress-free and fast.

Determine the Exact Worth of a Distressed Property

Buying a distressed property in the real estate investment industry has been a trend.

Perhaps, you’re planning to purchase a distressed home as well. Before you make a decision, develop the skill of determining the worth of a fix-and-flip house. ARV can make a huge difference. Before, it was hard to measure and identify the value of this type of investment. Things have changed today. Just calculate the ARV.

Downsides of ARV

The After Repair Value also has some drawbacks. While it helps investors set a remodeling budget and make a profit, it is a labor-intensive process. It requires effort and time. But it’s worthwhile and useful. If you have a hectic schedule, there are agents and other professionals that can assist you from start to finish.

Another downside of ARV is that the data can be inaccurate if done improperly. Of course, the information will be unrealistic. So, don’t take shortcuts. Enjoy comparing every important detail. To achieve precise and correct ARV, hire a professional for your convenience.

The Rule of 70%

Another term in real estate investment is the Rule of 70%. What is it? How does it work? Simply, it is a process of estimating the number of years for an investment property to grow.

The Rule of 70% is a calculation used to identify how many years it will take for your money to double. It is commonly used to compare investments with annual compound interest rates. The Rule is also called as a doubling time.

What’s the Formula?

Number of Years to Double = 70

Annual Rate of Return

How to Calculate The Rule of 70?

Real estate investment is complicated, right? The After Repair Value? The Rule of 70%?

Since you already knew how to compute the ARV, how about the Rule of 70%? There are only two methods required.

First, obtain the growth rate or annual rate of return on the investment/variable. Then, divide 70 by the annual rate of yield or growth. That’s it! There’s no complex procedure to follow.

Why is the Rule of 70 Necessary for New and Seasoned Investors?

The ARV measures real estate profit, enables you to set the renovation budget, helps you figure out the right selling price, determines the worth of a distressed property, and gives you confidence in making decisions.

The Rule of 70%, on the other hand, can help you determine the future value of your real estate investment. Yes, it could be a rough estimate. But the Rule is effective in identifying how many years it will take for your money to double.

The Rule of 70% is used to examine and assess the growth rate for a retirement portfolio, mutual fund returns, and other various investments in the industry.

Let’s say your calculation yielded a result of 15 years for your portfolio to increase. Then, you want the result to be close to a decade as an investor. What would you do? Experts suggest making allocation changes to boost your growth rate.

Whether you’re tired or overwhelmed with complex mathematical procedures in managing exponential growth concepts, the Rule of 70% is one of the accepted solutions to try. Say bye to difficult equations. Use this easy and simple formula today.

Where to Use the Rule of 70?

Aside from the real estate investment, the Rule of 70 is applicable in estimating how long it would take a gross domestic product to increase.

Just like the way you calculate compound interest rates; you could use the GDP growth rate in the divisor.

ARV In House Flipping

You have tried wholesaling, house hacking, live-in-then-rent, BRRRR investing, rental debt snowball plan, all-cash rental plan, crowdfunding, REITs, discounted note investing, and syndications.

What are the other real estate investment strategies to take advantage of today? House flipping should be your next venture.

House flipping is the process of buying and holding a property for a short period. Then, investors sell it to make a profit.

In house flipping, investors make a lot of renovations and repairs to sell a property at a high rate.

What Makes House Flipping Popular

Making a Good Profit is High

Businesses and professionals have turned to a fix-and-flip investment due to the potential of making a high profit.

For individuals and companies, house flipping is a profitable and lucrative business. They can acquire significant returns on their investment as well.

A Rewarding Experience

Apart from making money, a flip-and-fix investment offers new and great rewards.

If you renovate and sell an old residential/commercial property, you also increase its aesthetic value, comfort level, and security that a family deserves.

That’s not all! You may improve the quality of life in the neighborhood.

Personal and Professional Development

House flipping will take a lot of money and time. But there’s a valuable experience to gain.

Purchasing homes or materials, for instance, will develop your negotiating skills. The ability to manage your time and hold a team accountable will surely open other business opportunities in the future.

The risks of experiencing stress and losing a lot of money, however, are higher than you’ve imagined. Good news! Calculating the After Repair Value can tell investors an idea of whether or not a house flipping project is profitable.

During a thorough inspection of a property, it’s imperative to work with a general contractor to assist investors in putting a budget repair sheet together. It usually consists of necessary home renovation and costs, too.

Both the estimated cost of repairs and purchase price is used to compute the After Repair Value. Experienced flippers also recommend the use of 70% Rule. For further information, your team will stay at your side. So, don’t be afraid to ask and raise your questions.

How ARV Affects ROI?

House flipping has been popular for a reason. The profit and return on investment, for instance, are higher than ever. But before making a good ROI happen, it’s critical to calculate the After Repair Value.

In computing the ARV, conducting a comparative analysis is part of the process. Investors ensure that the real estate comps should be equal to the ARV. If the result doesn’t match, your investment/money is at risk.

Transform a Fix-and-Flip Property into a Profitable Space without Over-repairing

Over-repairing is a common mistake among new investors.

Of course, the fix-and-flip real estate investment strategy allows you to carry out some repair/reconstruction jobs. But don’t over-fix. Your overall goal of fixing property is to attract prospective buyers and increase ROI.

How to transform a residential/commercial space without overspending? Here are a few helpful tips to keep in mind:

Exterior/Interior

Repairing a distressed property can be a headache. While there are various renovation tasks, the exterior of the house is a perfect start. Trim shrubs, mow the lawn, remove the clutter, fill walkway cracks, replace windows/screens, add shutters, paint the garage, install gutter extensions, or replace light fixtures.

For the interior, you can install window blinds, patch the holes, apply a fresh coat of paint, check all doors, install light switches, replace the doorbell, re-carpet, repair exhaust fan covers, and more.

Kitchen

For the kitchen, you may consider installing a stainless steel sink, faucet, countertops, or cabinets.

Bathroom/Basement

For the bathroom, install a quality vanity/fixtures, replace the toilet seat/towel hangers/shower curtains, scrub the grout in the tiles, apply fresh caulk around the base of the tub/shower/sink.

After renovating the bathroom, it’s time to direct your attention to the basement. Make sure the cobwebs are swept, ductwork is dusted, dangling cables are tucked up, cracks in the walls are sealed, and floors are painted.

How to Cut Costs Without Compromising the Quality

House flipping is costly. New investors, for example, are likely to over-spend. So, they lose a large amount of money.

If it’s your first time to fix and flip a property, you want to reduce the repair costs while maintaining the quality features. How to get started? Here are a few ideas to consider:

Avoid Hiring a Designer

– Designers can restore the original state of any distressed property. They can enhance the resale value and curb appeal, too. But hiring a designer is expensive. Look for other professionals that will save you a penny.

Avoid a Large Construction / Renovation Company

– It’s tempting to hire a large reconstruction and renovation company for a house flipping project. Don’t have that thought in mind. Look for a small but reliable expert instead.

Pool all your Projects

– Since most laborers deliver a quality service available at a competitive rate, draw up a repair list and have them complete in one trip. When fixing and flipping a variety of houses, ask the company to consider a multi-project discount.

Don’t Be Enticed with the Hottest Offerings on the Market When searching for construction materials, purchase overstocked, and builder’s grade choices. You can also ask the manager or salesperson for cheaper options.

Buy User-Friendly Power Tools

– There are many tools to use for a house renovation. Some are time-consuming to utilize while others are tailored to finish the job according to your schedule. Invest in a quality heat gun, power washer, power roller, cordless drill, screw gun, circular saw, nail gun, belt sander, etc.

Expert Tips for Calculating ARV

Calculating the After Repair Value of a house flipping project is vital to the profitability of your fix-and-flip investment.

A too low or high estimate affects the marketability of your real estate investment.

Calculating the After Repair Value is a skill that investors should have. Don’t worry when you struggle to compute the ARV. The right research and constant practice should not be ignored.

Determine the Accuracy of Every Available Data

The first step in calculating the ARV is to verify the details of all the properties in your listing. Don’t forget to pull up the tax records to confirm the room count, square footage, legal neighborhood, school information, year of establishment, and other important data.

Find Your Comps for a Solid ARV and Do Some Research

After verifying available detail, research some comparable properties to enjoy immense value when estimating the After Repair Value.

How to Find Comps for an Investment Property?

Finding comps for your investment property can be troublesome, especially when you’re a less experienced investor. Worry no more! You can start with the neighborhood or legal subdivision. Next, look for one of the most sought-after real estate listings.

After that, go back one full year while focusing on the last six months. Then, direct your attention on sold.

But if you can find a rehabbed sale, it is one of the best comps you can have.

Plus, print the comparative market analysis report if you have full access.

How to Narrow Down the Best Combs?

Perhaps, you’ve begun searching for combs. There are many options, right? While the selection can seem easy, the number of solutions is quite tricky to handle. The trick is to narrow down the combs.

You can start with the highest sales. Be sure the lot size and year built are comparable. Then, check the room count, construction type, square footage, and other important elements. Also, don’t forget to compare the aesthetic value/curb appeal of a property.

What are the Other Things to Check?

Now you found comps that best fit your unique needs and expectations, there are other things to verify, which include the flooring, appliances, cabinets, kitchen countertops, bathrooms, stand-up showers, tub surrounds, overall fresh interior, and windows.

Important Characteristics of a Property to Consider when Calculating ARV

The number of bathrooms, bedrooms, and square footage are some important characteristics of a property when estimating the After Repair Value.

To measure the value of available options, compare the house to other properties with similar characteristics.

For appearance or quality differences, make some subjective adjustments.

Then, look at sold properties. Get rid of properties that are listed for sale because the listing price does not reflect the true value of the choices.

Conclusion

Fix-and-flip real estate investment has been creating a buzz among businesses and professionals over the years. Unlike the other investing strategies, house flipping provides a quick profit. It gives investors the chance to acquire new experience, access the local market, gain buyer insights, budget for unanticipated costs, and increase network.

Fixing and flipping a real estate property is risky. Investors may lose money, deal with unexpected expenses, and handle higher taxes.

But there’s an excellent way to reduce the risks and maximize ROI. Calculating the After Repair Value can come into play. For those who have never experienced estimating the ARV, the services of a professional are worth the cost.

ARV CALCULATOR

How much is my property worth?

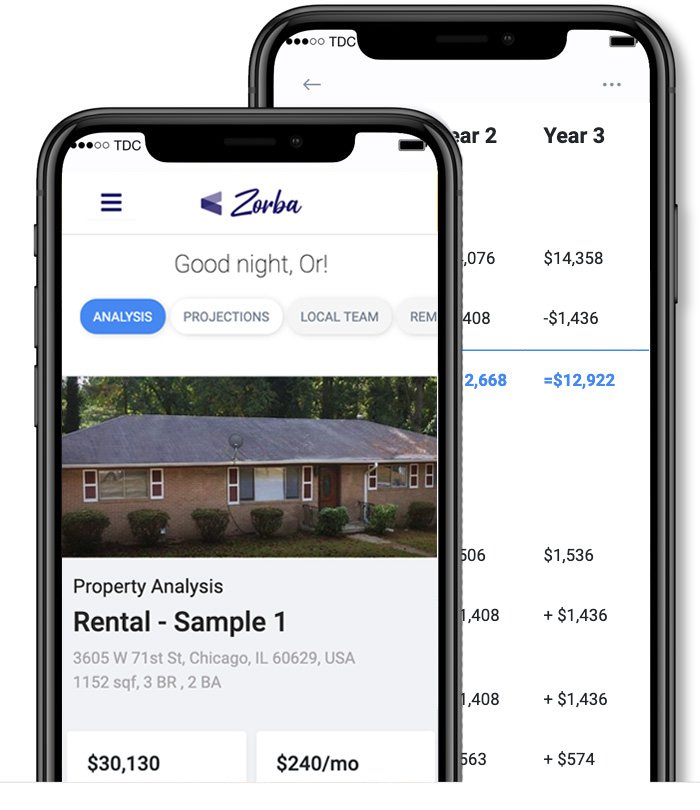

See how your Zorba offer compares

We’ll make a competitive, no-obligation offer on your property. If you love the offer, we’ll purchase your home directly from you so you don’t have to list it.

Get expert flipping houses

tips in your inbox

and stay on top of local trends.

NEW

Now Zorba helps you analyse and compare deals

Zorba uses the power of Automation and AI to help you better estimate and maximize your profits. Oh and it’s 100% free to use!